In the broadcast media industry, there has long been speculation that sports bodies could follow the vertical entertainment model by launching their own global subscription platforms instead of licensing rights to regional broadcasters. In 2022, the football governing body FIFA launched a streaming platform, FIFA+, as an ad-supported entry into direct-to-consumer programming. More recently, FIFA has signalled intent to publish its own video game, while the English Premier League’s decision not to renew its long-held production deal with sports marketing and media agency IMG has been widely interpreted as a move toward creating its own streaming infrastructure.

According to global strategy consulting firm Altman Solon, one side effect of digital-first fandom is the rising prominence of sports simulation video games as a touchpoint for younger audiences. The NBA stands out in particular, with around two-thirds of fans aged 18 to 34 engaging with the league through NBA 2K. Among that same age group, nearly half of MLB and NFL fans also play their respective leagues’ flagship video game titles.

As the next generation of fans increasingly interacts with their favourite teams through video games, rights holders are poised to demand greater control over how their IP and associated media inventory are managed and monetised. For the gaming industry, this shift underscores an urgent need for collaborative systems that enable sports rights holders to build direct relationships with gamers and brand partners.

While sports rights holders are finding new ways to go direct-to-consumer in other media verticals, gaming presents a unique challenge because creating a high-quality video game is a monumental undertaking that requires massive upfront investment and a dedicated development pipeline. If FIFA were to become a video game publisher, it would need to transform from being the governing body responsible for organising international football tournaments and overseeing global governance into a bona fide media company that can build and maintain complex technology infrastructure and transact directly with hundreds of millions of consumers across continents, languages, and cultures.

However, while FIFA and other governing bodies face significant barriers in developing and publishing their own video games, teams have an opportunity to assert greater influence over how licensed IP manifests inside existing games. In 2025, teams are well placed to push for new terms with game developers that allow them to independently manage and monetise virtual environments, in parallel with real-world properties, as part of a revenue share, thus lowering upfront licensing costs through carriage deals based on inventory performance. Gaming industry executive Jonathan Bunney is bullish on brands recognising the opportunity that virtual sports sponsorship presents to them:

“Over the last few years, we’ve seen a real shift as brands are waking up to the opportunity that sports simulation video games offer. Where they once expected to be included for free to help with authenticity, many are now willing to pay for the exposure because they know deep down that many of their consumers spend more time playing and watching sports in video games than they do watching real-life sports events. It’s a big swing in mindset, and a huge opportunity for developers, publishers and the sport industry's smartest marketers."

Jonathan Bunney

Industry Advisor, ex-EA, Codemasters

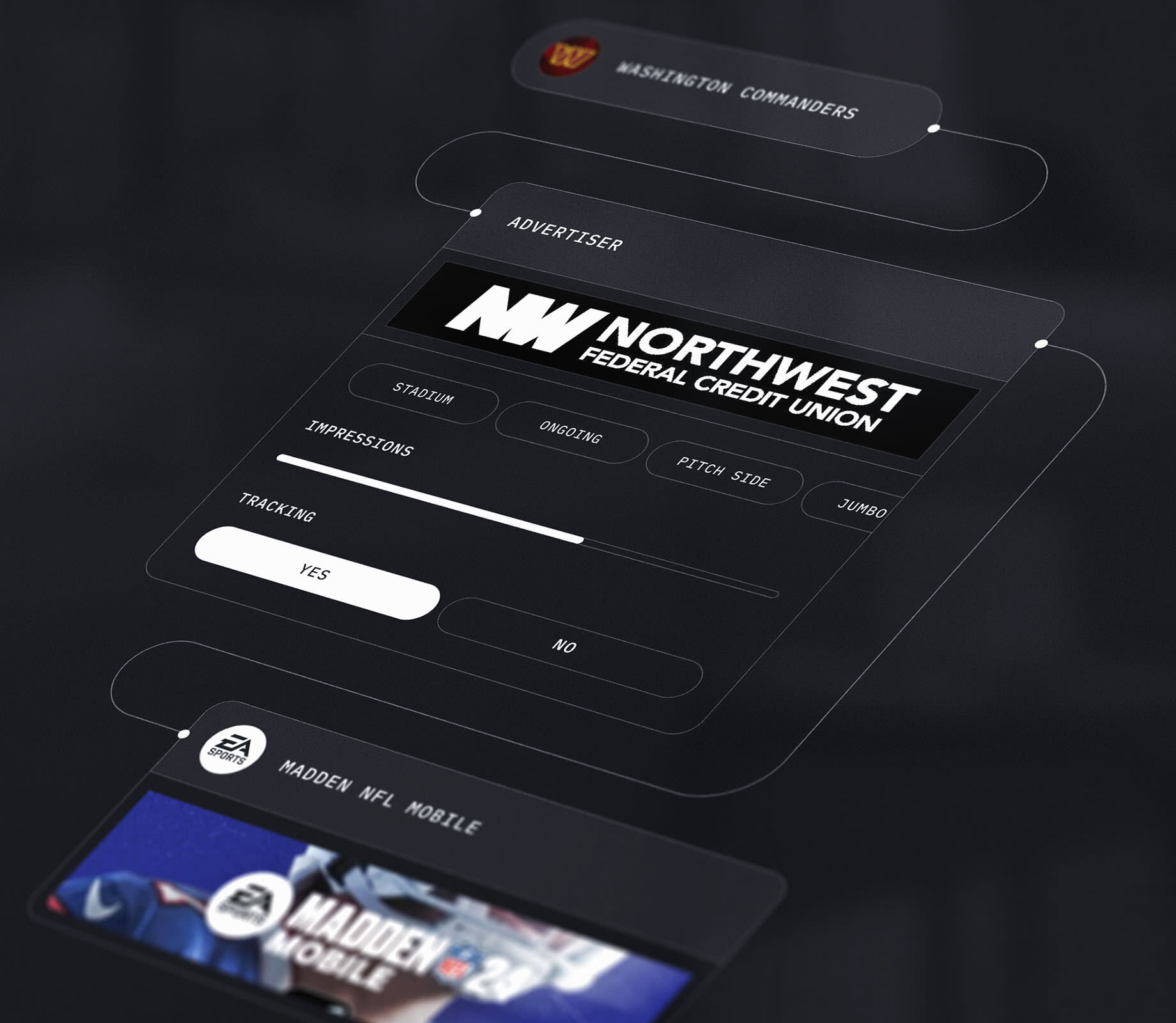

Sports teams are already bringing media planning and buying functions in-house, particularly across social and digital channels but realising the same agility in video games, whether for first- or third-party campaigns, hinges on the development of content management systems that enable in-game environments to be segmented and shared between game developers and their chosen partners.

In the sports marketing and sponsorship space, advertisers want rights holders to provide actionable insights into who their fans are and the tools to engage those fans directly. A luxury brand like Porsche, for example, might not benefit from associating with a football team purely on scale if most fans don’t match their customer profile. However, if a club can identify a targeted segment of high-net-worth individuals who are brand-aligned, using first- or third-party identifiers or some combination of deterministic signals such as age, gender, or geolocation, then that opens up an entirely new commercial proposition. Here, privacy-enhancing technologies, also known as data clean rooms, such as WPP's InfoSum, which are powered by secure multiparty computation, offer the potential for sports teams, game developers and advertisers to exchange data, enhancing the granularity of audience segmentations and campaign targeting while keeping sensitive player information anonymised.

In general, the future of media spend is migrating into data-rich environments, where you can know your audience in a way that traditional sports sponsorship has not before. Unlike traditional media, video games offer persistent signals and a rich, addressable audience profile. Sports and media executive Jarod Were recognises the pivotal role that data has to play in emerging forms of sponsorship and advertising:

"Publishers who have made significant investments in licensing valuable content and franchise IP are under pressure to secure meaningful returns. The ability to identify and target specific user segments by leveraging robust data, not only platforms and devices, but also audience demographics, sentiments, and potentially purchasing behaviours, will enable the delivery of campaigns that resonate deeply and authentically with priority audiences. The result is a win-win: a better experience for consumers, stronger ties and more profitable partnerships between publishers and brands."

Jarod Were

Sports & Media Executive, ex-Bain, NHL, Supponor

While sports teams have historically lagged behind other consumer and entertainment brands in customer relationship management and segmented marketing, the industry now has a significant opportunity to skip a technology cycle and fully embrace and double down on their presence inside IP-licensed video games.

According to PwC, revenues from real-world sports sponsorship are projected to grow to $109 billion by 2030. Still, brand sponsorship in gaming has yet to generate significant revenues. As it stands, an expectation gap exists between go-to-market strategies and underlying content management systems, which prevents collaboration between game developers and rights holders. Although partnerships and use cases will vary in scope, the need for permission-based content management systems that enable gaming media to be modular and accessible to different parties is universal.

Game developers have an opportunity to close this gap by providing rights holders with the solutions required to ringfence and manage their own commercial environments. Modular permission-based systems can be leveraged to assign levels of control to third-party users, allowing rights holders to manage virtual placements in IP-licensed gaming environments and monetise them through regional brand deals. Crucially, these systems can incorporate layered permissions, including creative approvals and usage constraints, to ensure campaign activity does not compromise the playing experience.

For rights holders, future growth in sports simulation video games will undoubtedly depend on a mix of complex factors, but three pillars stand out as foundational. First, rights holders must establish greater control over how their IP is represented and monetised, enabling them to shape real-time campaign experiences and build direct relationships with players. Second, success depends on structural models that are commercially feasible, allowing rights holders to participate without needing to build games themselves. Third, there is a growing imperative to unlock data-driven player insights, the kind that power audience targeting and campaign measurement. Ultimately, progress will depend on a technical infrastructure that supports modular and secure collaboration among rights holders, game developers, and brand partners. Sports rights holders that pay attention to these principles now will be best positioned for the future, less as subjects of change and more as masters of their own course.